The Crisis in US Healthcare

- Jimmy Song

- Jul 20, 2023

- 6 min read

Updated: Sep 16, 2024

The US has higher costs per person, but produces worse outcomes

The healthcare system in America is broken. When it comes to value – outcomes vs cost, arguably the most critical health system metric – the US is the worst amongst developed countries. Healthcare expenditures in the US continue to rise as a percent of GPD, currently sitting at 18.3%. This is up from 17.2% in 2011 and 14% in 2001 (CMS), while the average for OECD countries is 8.8%. Additionally, the healthcare spend per capita in the US is multiples higher than in other developed countries. In the US, it was $12,914 in 2021 (CMS), whereas in the United Kingdom it was £4,188 (about $5,780) (Office for National Statistics, UK), and in the EU it was just over €3,100, or about $3,720 (Eurostat).

Despite such high costs, the US healthcare system ranks last in performance amongst high income countries across a variety of factors, including access to care, equity and healthcare outcomes.

High costs, late diagnoses, and a system that focuses on acute or late-stage chronic care versus prevention leaves patients in a tenuous financial position

These high costs are driven by the soaring rates charged by providers (hospitals and physicians) for expensive interventions that result from addressing diseases in their latter stages, the high premiums charged by insurers, the massive deductibles and co-insurance costs that patients must bear, and the general focus on acute and chronic care, which is much more expensive than preventative care.

The average deductible in the US, the amount of money a patient must pay out-of-pocket before health insurance coverage kicks in, was about $1,800 for an employee of a medium-to-large-sized company, and about $2,500 for an employee of a small company.

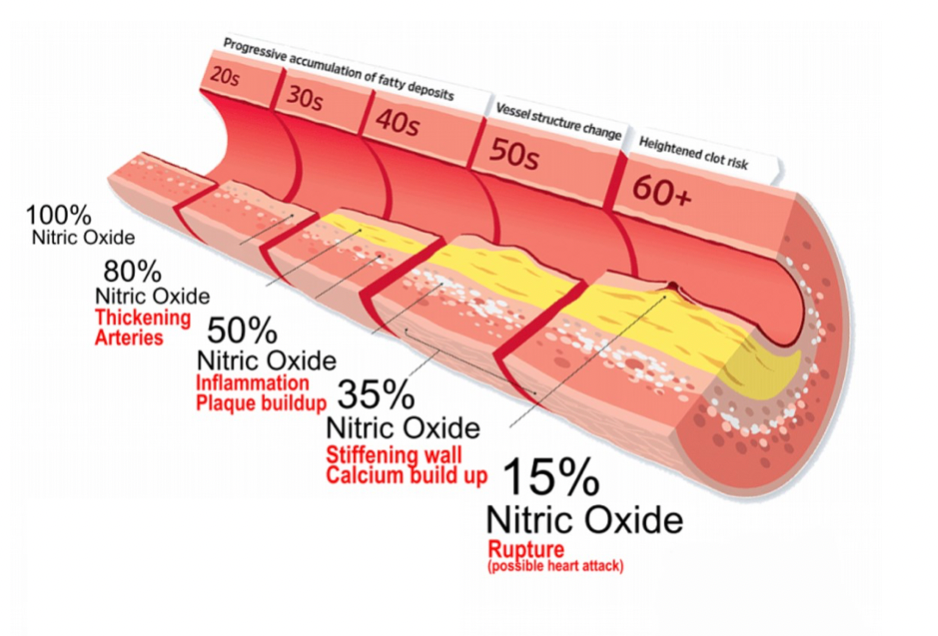

As the saying goes, “An ounce of prevention is worth a pound of cure.” But currently, too much of the healthcare system focuses on acute or chronic care rather than prevention. Identifying disease states in their earliest stages means the interventions are much more cost-effective and the prognosis for survival are much higher. According to the CDC, chronic diseases are the leading cause of illness, disability and death in the US. They are the main drivers of the country’s $4.1 trillion in annual healthcare costs. Avoidable chronic diseases account for 75% of the nation’s healthcare spend and lower US economic output by some $260 billion per year (CDC).

Aside from the problem of late stage diagnoses and costly treatments, most insurance plans require the patient to pay co-insurance, or a percentage of every dollar of coverage beyond the deductible. So, the insurer on average would pay about 70-80% of a given medical bill beyond the deductible, and the patient would still need to pay the remaining 20-30% of the hospital bill. But given the high cost of care in America, these co-insurance costs add up quickly.

A construction contractor in Tennessee had to make a trip to the ER for 6 stitches to close up a cut on his knee and for a tetanus shot. This visit cost him nearly $6,590. Because of his high deductible plan and co-insurance, he had to pay $4,278 of that amount out-of-pocket. A woman in South Dakota who battled and beat breast cancer had to beat back bill collectors after racking up more than $30,000 in medical debt due to having multiple surgeries, radiation and chemotherapy. Cancer survivors in medical debt are in much more of a precarious financial position than non-cancer patients because of the major costs associated with cancer treatment. Their rates of bankruptcy, eviction or foreclosure on their homes are much higher compared to non-cancer patients (23% vs. 15%).

Forty-three percent of working-age adults were inadequately insured in 2022, meaning they were uninsured, had a gap in coverage during the previous year, or were underinsured, i.e. they didn’t have sufficient coverage to properly access the healthcare system (Commonwealth Fund). Any sudden or unexpected need for medical services or chronic care treatment after an acute event could have had catastrophic financial consequences. It is why so many people avoid getting medical attention in the US even when they need it.

In a recent Gallup poll, 38% of Americans say they or a family member postponed medical treatment due to the high expected cost in 2022, up from 26% in 2021. This is the highest rate ever in the poll’s 22-year history. Of this number, 71% said it was for a very or somewhat serious condition or illness. Lower income households who earn less than $40,000 per year are nearly twice as likely as those with incomes of over $100,000 to say that they or someone in their family delayed medical care for a serious condition.

The New Epidemic – Medical Debt and Bankruptcy

The high cost of insurance and poor coverage has led to a new epidemic in America – that of medical debt. According to a recent survey by Commonwealth Fund, 41 percent of American adults ages 19-64, or 72 million people, have outstanding medical bills or medical debt. That’s up from 2005 when the same figure was 58 million people, or 34 percent of American adults, respectively. Add in the 7 million elderly adults also dealing with the same issue, and that’s 79 million Americans currently suffering from this issue. Additionally, it is most intensely and disproportionately experienced by low and moderate income families.

According to a U.S. Census Bureau analysis of household medical debt levels, 17% of US households held medical debt in 2019. The analysis also found that of that number, 23 million people owed significant medical debt – with 16 million people owing over $1,000 in medical debt, and 3 million people owing more than $10,000 in medical debt. The groups holding the largest amount of medical debt were between the ages of 35-49 and 50-64 (just before eligibility for Medicare kicks in but also when earning power is about to drastically decline).

The Consumer Financial Protection Bureau estimates that approximately $88 billion of medical debt is reflected in Americans’ credit reports. But it acknowledges that the total amount of debt is likely higher because not all medical debt is visible to consumer credit reporting companies. Medical debt can also be masked as other forms of debt, i.e. in the form of credit cards – used to pay for medical debt, or when patients fall behind on payments for other things in order to keep up with their medical bill payments, such as housing or car payments.

Additionally, people with medical debt report cutting spending on food, clothing and other essential household items. Along with these cost-cutting measures, they tend to spend their savings and in some cases borrow additional money from friends, family, or other debt providers in order to pay down their medical bills (Peterson-KFF).

Worst of all, when the burden of servicing medical debt becomes too overwhelming, it forces many into the unfortunate position of having to file for personal bankruptcy. In some cases, this results in the loss of their homes. Personal bankruptcy filings also leave a permanent mark on one's personal credit score and will forever impact one's ability to borrow in the future. In a study published in the American Journal of Public Health in 2019, “Medical Bankruptcy: Still Common Despite the Affordable Care Act”, it found that 66.5% of bankruptcies were caused directly by medical expenses, making it the leading cause of bankruptcy in the US. Additionally, 17% of adults with healthcare debt declared bankruptcy or lost their homes as a result of it. Overwhelmingly, Americans (45%) worry that a major health event will bankrupt them.

The System Must Change; It Is Unsustainable

This is the present state of healthcare in America – people living in perpetual fear that they will get sick, get in an accident or develop a chronic condition that requires long-term care. Given the rates of medical bankruptcy in the US, this fear is real and omnipresent. Even if bankruptcy can be avoided, patients will likely still be saddled with massive amounts of debt that will take a disproportionate amount of time to pay off, and in the interim significantly reduce one's quality of life. Compounding these costs are the fact that many of these diagnoses are latecoming, thus the initial and ongoing cost of treatment is materially higher than it would be if such issues were identified in their earlier stages and addressed preemptively.

We do not believe it has to be this way. Aside from requisite policy changes, with the available advances in technology and the growing trend of patients taking more ownership of their own health, we can create and utilize advanced tools that enable users to more proactively monitor their health, identify the earliest stages of disease or risk development, and preemptively address such issues before they further deteriorate. Thus improves the odds of a positive, cost-efficient outcome – and limits the possibility of a catastrophic one.

Comments